QR Codes have seamlessly integrated into our daily lives, and the United Kingdom is no different.

In this blog, we delve into the phenomenon of QRs in the United Kingdom, exploring their growing significance, widespread adoption, and the myriad of ways they are reshaping industries across the nation.

Businesses across the UK continue to embrace QRs as a dynamic tool for engagement, efficiency, and innovation.

Whether you’re a business owner seeking to leverage QRs to streamline operations or a consumer eager to explore their convenience, this blog aims to be your comprehensive guide to navigating the QR revolution in the UK.

A. QR Codes in UK

In recent years, the adoption of QRs has surged notably in the United Kingdom, surpassing that of other European nations, with an estimated 13% of all users in Europe now utilizing this technology. This figure exceeds the global average, which hovers around 8%.

The UK has witnessed a rapid expansion in the availability of QR payment solutions, with prominent supermarkets and high-street retailers embracing this technology for transactions.

Consequently, an estimated 5 million individuals in the UK currently employ QRs as a payment method for various goods and services.

Furthermore, the proliferation of mobile commerce has contributed to this growth, with many small-scale enterprises offering customers the convenience of QR payments.

However, the utility of QRs extends beyond payment transactions within the UK. They are increasingly utilized across diverse sectors, including educational institutions, where they serve purposes such as information dissemination and access to digital content.

In general, the adoption of QRs in the UK is experiencing rapid growth, with technology emerging as a progressively favored payment option within the region.

This trend is expected to persist as an increasing number of retailers and businesses opt to provide QR payment solutions to their clientele.

B. Citizens of the UK and their online behavior regarding QRs

In September 2020, Google search activity related to QR Codes peaked in the United Kingdom, but interest in the topic noticeably declined by early 2023.

While QRs serve various purposes, particularly revolving around contactless payments via smartphones or wearable devices, their prevalence in the UK surged following the onset of the coronavirus pandemic.

Before this, the UK already boasted a substantial penetration rate of debit card usage. However, pinpointing exact domestic transaction statistics for QR payments remains challenging, hindering direct comparisons with debit card usage.

Existing data primarily stems from consumer surveys, which gauge the extent of QR Code payment adoption among respondents.

C. Increase of QR Code usage since shelter-in-place began

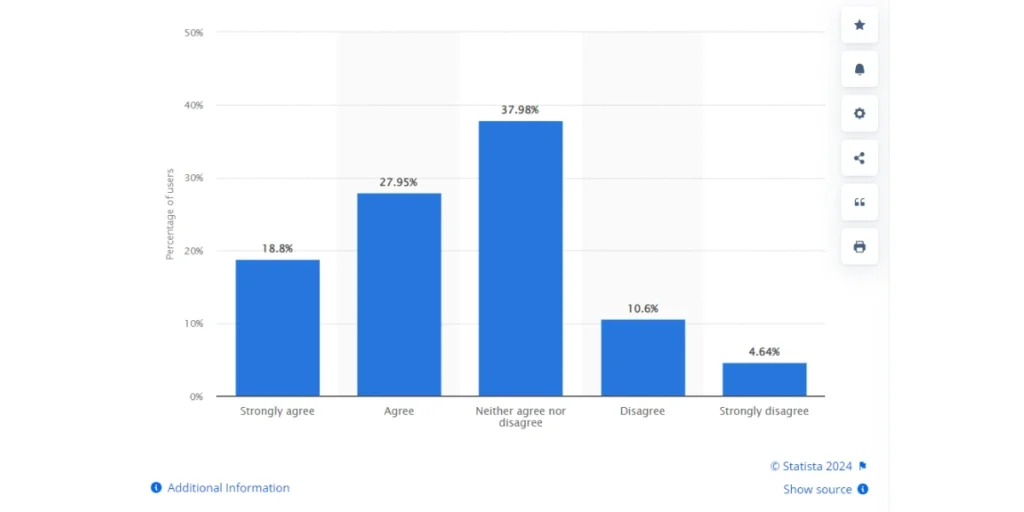

In a survey conducted in September 2020, it was discovered that 18.8 percent of consumers in both the United States and the United Kingdom expressed strong agreement regarding the heightened visibility of QR utilization since the initiation of COVID-19-induced shelter-in-place directives in March 2020.

Generate a QR Code For Your Unique Case

START TODAY!D. UK citizens feel the most secure scanning QRs in these locations

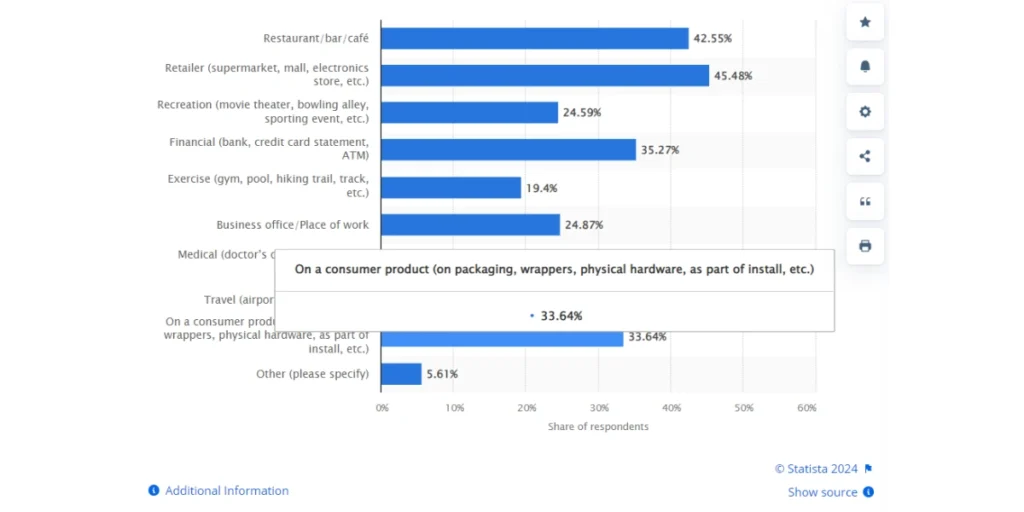

In a survey conducted in September 2020 among consumers in the United Kingdom, findings indicated that 42.55 percent of respondents expressed a greater sense of security when scanning QRs at restaurants, bars, or cafés.

In contrast, only 19.4 percent of participants reported feeling similarly secure when scanning QR codes in exercise-related settings.

E. Digital payment statistics in the UK

In the UK, digital payments primarily revolve around debit cards and the increasing prominence of mobile wallets.

Notably, global brands hold sway over domestic counterparts. In a survey conducted in 2022 regarding payment brand usage in stores or restaurants via mobile devices, nearly seven out of ten respondents cited Apple Pay.

While Barclays enjoyed considerable brand recognition as a digital payment option, its actual usage remained relatively low. Despite the rise of digital payments, cards maintain their supremacy in both point-of-sale (POS) and e-commerce transactions in the UK.

This dominance is particularly evident in POS payments, largely due to the widespread integration of contactless technology in issued credit and debit cards.

Digital payments encompass various online and offline cashless methods, excluding traditional banknotes or coins.

These methods encompass mobile payments conducted via smartphones and encompass emerging trends such as buy now, pay later (BNPL), cryptocurrency, and instant (real-time) payments.

Younger individuals demonstrated a keener interest in Apple Pay, Google Pay, and Samsung Pay compared to their older counterparts. More than half of the population aged 16 to 24 had registered for mobile payments.

UK Finance, the domestic payment association, anticipates that older age demographics will gradually embrace mobile payment technologies over the next decade.

However, whether this trend will lead to the replacement of traditional cards remains to be determined. Predictions suggest a slight decline in the number of credit cards in circulation between 2022 and 2028, albeit by a modest 20,000 cards.

Conversely, the forecast for debit cards tells a different story: a projected increase of 6.4 percent in the usage of debit cards in the UK by 2028.

The United Kingdom is actively pursuing various initiatives to modernize its payment infrastructure through the integration of new technologies.

A prominent undertaking is the New Payments Architecture (NPA), which is slated to replace the existing Faster Payments (FP) and BACS clearing systems, consolidating them into a unified central payments infrastructure for both retail and wholesale transactions by approximately 2030.

While the UK already boasts real-time payment capabilities through the Faster Payments scheme, which facilitates bank transfers, the NPA aims to streamline and enhance this process further.

Additionally, significant efforts are being directed towards the exploration of Central Bank Digital Currency (CBDC) in the UK. The country has emerged as a key player globally in researching CBDCs, particularly for their potential application in cross-border interbank payments.

Furthermore, UK financial authorities are actively considering regulations for the burgeoning buy now, pay later (BNPL) sector between 2023 and 2025.

Forecasts suggest that by 2024, approximately seven out of ten UK merchants will integrate BNPL options into their online platforms, underscoring the growing significance of this payment method within the UK retail landscape.

F. Real-life examples of QR Codes being used in the UK

1. Food packaging

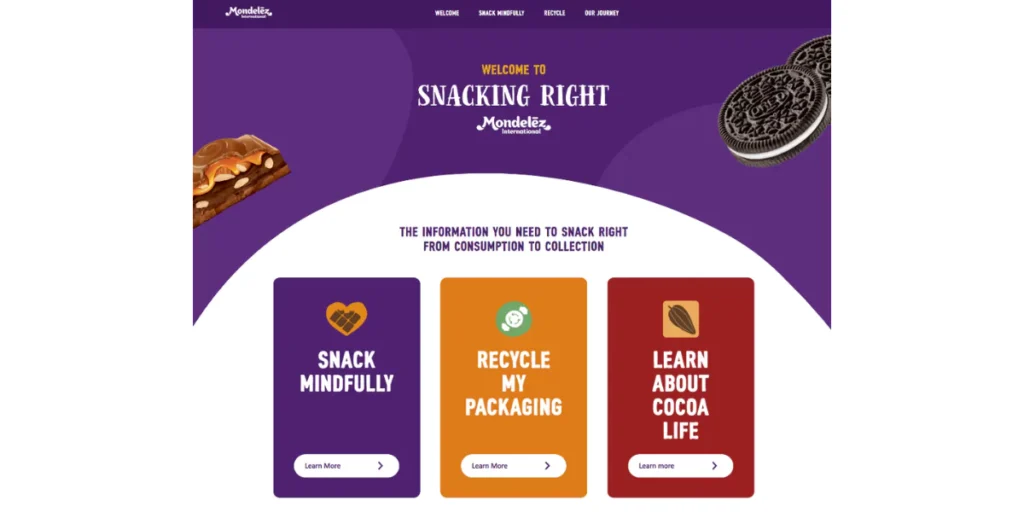

This initiative includes insights into recycling practices and encourages mindful snacking to promote healthy habits among consumers.

By scanning the QR featured on the outer packaging, consumers will gain access to a newly introduced online platform called ‘Snacking Right.’

This platform offers comprehensive details about the company’s global Snacking Made Right program, featuring insights into recycling, tips on mindful snacking, and information about the Cocoa Life cocoa sourcing program.

The QR Code pilot will be integrated into the company’s on-pack summer promotion with Merlin Entertainments, encompassing a variety of Cadbury, Oreo, and Barny products.

Additionally, the Snacking Right platform is poised to incorporate additional brands, products, and geographical regions in the future.

2. Public transportation

Thanks to a collaborative effort between First Bus, Great Western Railway (GWR), and the ticket machine provider Ticketer, passengers can now access bus and rail services seamlessly through a single QR Code. This innovative partnership allows travelers to purchase a combined rail and PlusBus ticket for their entire journey with First Bus and GWR, facilitating travel to and within Weston-super-Mare with just one electronic ticket.

The electronic rail and PlusBus tickets can be acquired from GWR onboard and at stations, where tickets with QRs are issued to the Rail Delivery Group standard and made accessible via smartphones.

Subsequently, passengers can scan and validate the QR using the Ticketer Electronic Ticket Machines (ETMs) available onboard all First West of England Badgerline services within Weston-super-Mare.

3. Retail shops

John Lewis, a well-known UK department store, is bridging the gap between online and offline retail experiences by introducing a virtual store where shoppers can conveniently purchase products using their smartphones through QRs.

As reported by Power Retail, the Waitrose store in Brighton showcases a window display featuring QR codes that allow shoppers to buy items from the retailer’s curated ‘Top 30 Favorite Things for Christmas’ list, which includes popular products like Lego toys and the Amazon Kindle.

Upon scanning a QR, shoppers are directed to the John Lewis mobile site to complete their purchase.

Products ordered before 7 p.m. are available for in-store pickup the following day, providing customers with a seamless shopping experience blending digital convenience with traditional retail.

4. TV shows

The BBC plans to integrate QRs into The Good Cook TV series, aiming to provide viewers with supplementary content accessible via their mobile devices.

This initiative marks the debut of QRs in a UK cookery program, a technology already prevalent in newspaper advertisements and out-of-home sites.

Through these QRs, viewers can access recipes and information about ingredients showcased in the show.

The codes are compatible with smartphones equipped with cameras, allowing viewers to engage with the content in real-time as they watch the program live or via BBC iPlayer, as reported by Broadcast.

5. Government initiatives

In the Government’s latest efforts to enhance competition within the energy sector, energy bills will now feature a Quick Response (QR) Code.

This addition is intended to streamline the process for customers to compare prices and transition between providers, ultimately facilitating easier access to information and options for consumers.

6. Tourism

Tourist destinations in Cornwall used large QR Codes to facilitate conservation donations. As the popularity of staycations surges amid the pandemic, visitors are presented with the opportunity to contribute to the preservation of various scenic locations by simply using their smartphones.

7. Healthcare

Bayer Consumer Health UK has debuted an inclusive QR in the healthcare sector. Teaming up with Zappar, Bayer Consumer Health UK has introduced a new Accessible QR code (AQR) on the packaging of its Canescool Soothing Gel Cream product, aiming to assist individuals who are blind or partially sighted.

8. Hospitality

According to Statista’s findings from an April 2021 survey, approximately 37% of respondents in the UK expressed readiness to utilize QR payments at restaurants or bars.

9. Education

At Nottingham University, the introduction of the Student Engagement Dashboard enables colleagues to pinpoint students who might benefit from extra welfare or academic assistance. This dashboard amalgamates data from Microsoft Teams, Moodle, and Echo360 to offer an overview of student engagement. The inclusion of attendance data from in-person teaching sessions enriches the depth of this engagement analysis, and now, data from QR codes is incorporated into the Student Engagement Dashboard as well.

Generate a QR Code For Your Unique Case

START TODAY!Summing Up

As we look to the future, it’s evident that QRs will continue to play a significant role in shaping the landscape of commerce, communication, and beyond in the UK.

If you’re still reading, you’ve learned everything about QR Codes UK. If you have any questions, let us know in the comments.