QR Codes today are being used across industries and for diverse use cases. Anyone with a smartphone can scan them and are thus they’re becoming increasingly popular.

One of the most popular applications is the use of QR Codes in payments. QR Code-based payments are quick, easy, secure, and reliable. And they are facilitated by various apps such as Paytm, PhonePe, and Google Pay.

Among all, Paytm is the most widely used app for QR Code payments in India. It provides cashless payments in a safe and secure environment. You must have made a transaction using Paytm in grocery stores, shopping malls, or to pay for your Uber ride.

Besides, with the app, you can shop at Paytm mall, buy air and train tickets, book movie shows, and do loads of other things.

In this article, we will tell you all you need to know about QR Code payments through Paytm.

Keep reading.

A. How to make payments through Paytm

Through Paytm, you can send and receive money easily. And there are multiple ways through which you can make a transaction. In this section we will detail on all the ways.

But before you make a transaction, make sure you have a sufficient balance in your Paytm wallet. You can recharge it through credit card, debit card, UPI, or net banking. Once done, you can pay by either of the two methods:

a. By scanning a Paytm QR Code

Say you are at a grocery store. And the store accepts payments through Paytm. So, in order to pay for the items you bought through the store, you need to follow some simple steps:

1. Open the Paytm app in your smartphone

2. Now, tap on the Scan & Pay option

3. The scanner will now launch. Now, bring the scanner close to the QR Code provided by the merchant

4. Once the scanner detects the QR Code, you will be landed on the payment page. Here, you will be able to see the merchant detail (probably the name)

5. Now, specify the amount to be paid. You can also add comments, if any, which is optional. Once done, tap on Pay

6. Once the transaction is successful, you will receive a confirmation on the screen. Plus, you will also receive an instant message on your phone once the transaction is complete

This way you can easily make a payment through Paytm at your local grocery shop or restaurant. Once you pay, the respective amount will be deducted from your wallet.

Note that if you don’t have sufficient balance in your wallet, you will first be prompted to add money. This would be done during the transaction without navigating away.

b. By scanning a UPI QR Code

You can also make UPI payments through Paytm by scanning a UPI Code. The steps, which you need to follow to launch the scanner are similar to the ones mentioned above.

So, once the scanner detects the QR Code, the payment page will open. Here, specify the amount and choose the option to pay through the UPI-linked bank account.

It will then take you to the UPI interface. Here, you need to enter your UPI security PIN. Once done, click on the Submit button.

Your payment will get confirmed. And the payable amount will get deducted from your linked bank account.

In addition, you will also receive an SMS from the bank confirming the deduction.

B. How to receive payments through Paytm

In this section, we will brief on the way through which you can receive payment through Paytm:

a. Through Paytm wallet QR Code

Each account has a QR Code associated with it. To find this QR Code on your Paytm app, click on more options (3 lines) on the left. Once done, you will see the QR Code icon with the Share button option.

In order to receive payments, here are the steps you need to follow:

1. Go to Paytm and click on the Scan & Pay option on your dashboard

2. Here, click on the Show Payment Code option and you will see your Paytm QR Code

Once you see the placard, take a screenshot. You can now email the image to yourself and take a print out for a clear QR Code image.

Please note that this option will only be available if you have the latest version of the Android app i.e. v5.5.12 and above.

Once the other person makes the transaction, the balance will be added to your Paytm wallet.

You can also receive payment through your registered Paytm mobile number. The person making the payment just needs to have this contact. And he can make a transaction from anywhere such as sitting at home/office or on the go.

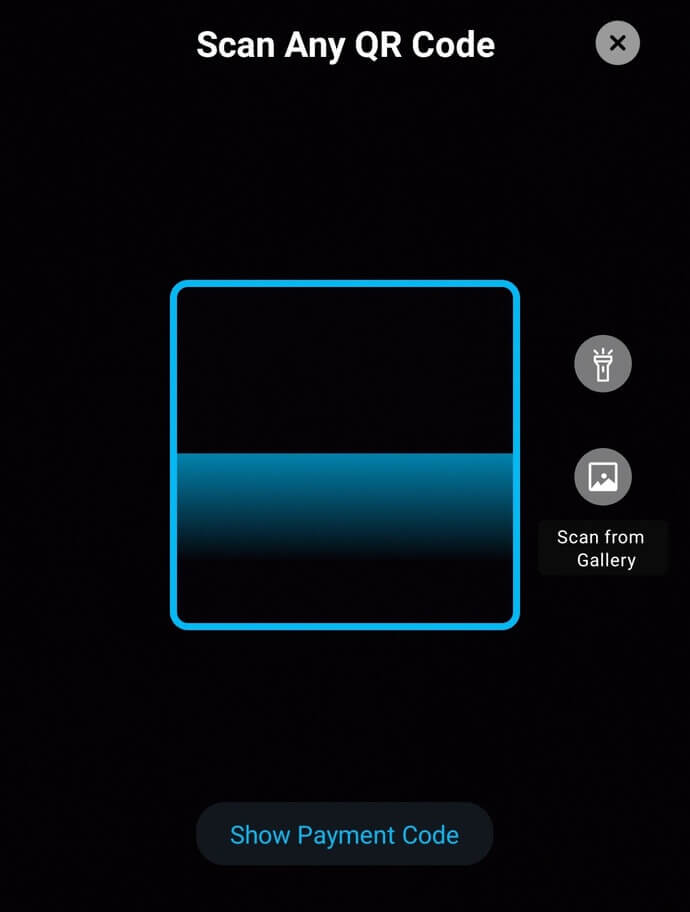

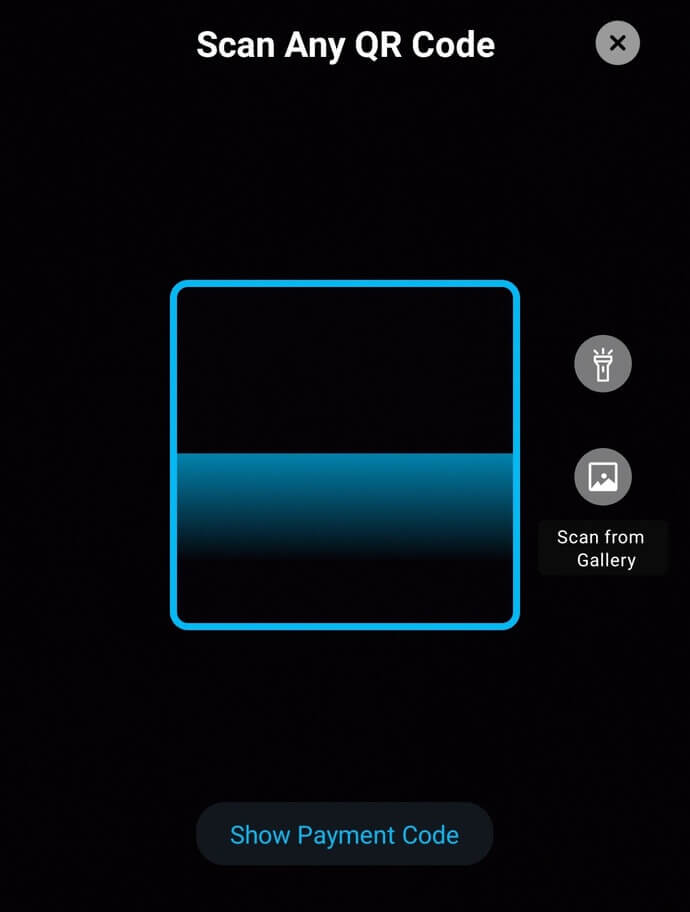

C. Paytm QR Code Scanner

Paytm scanner has the capability to scan any QR Code. That means, it can scan QR Codes other than the Paytm QR Code. The scanner can scan generic QR Codes, which have URLs, contact info, and text encoded.

To launch the scanner, you need to follow these simple steps:

1. Open the Paytm app on your smartphone

2. Now, on the bottom of your screen, tap on the Scan Any QR Code option

3. The scanner will now launch. Now, hold it in front of the QR Code and you will be redirected to the encoded content

In the same step, you can also scan any QR Code image from your gallery by clicking on Scan from Gallery

That’s it. That’s how easy it is to scan any QR Code using Paytm.

For more information, you can refer to this detailed guide on Paytm QR Code scanner.

D. How to generate Paytm QR Code for retailers and shopkeepers

For merchants and retailers who want to introduce digital payments, can do so with Paytm. They just need to download the Paytm for business app and generate their QR Code. Here’s how:

1. Install Paytm for business on your smartphone. Once installed, click on Sign Up for free

2. Now, enter your Name and PAN or Aadhar Number

3. Next, fill in your business and bank details

4. Once you have logged in, you can tap on the Order QR Code sticker

5. Now, tap on Show QR Code. Your QR Code will be generated. You can also share this QR Code on messaging apps

6. Last, you need to click on Activate QR Code at the bottom of your screen

You can now print this QR Code and place it on a convenient place such as on a glass stand at your shop. This way, you can receive cashless payments quickly and easily.

Paytm All-In-One QR

The Paytm QR Code for business is your ultimate All-In-One-QR-Code.

It has the following features:

- The QR Code accepts all payment modes such as Paytm wallet, UPI apps, credit/debit cards, EMI, and net banking. That is, the QR Code acts as a single point of reconciliation for all your payments

- With the QR Code, you can monitor key metrics and view analytics. The data will prove essential for your business and growth. You can see the data by clicking on Home option on your dashboard

- You can also manage your account. That is, you can view payments, bank settlements, initiate refunds, and manage disputes. This can be accessed by clicking on the Transaction option on your dashboard

Hence the All-In-One-QR provides an impetus for you to grow your business.

Thus, this is all you need to know about Paytm QR Code payments. Grocery stores, chemist shops, cabs, tea stalls, restaurants, and petrol pumps—all accept Paytm Payments.

More than 8 lakh merchants are accepting Paytm payments, and the count is only increasing with each passing day. Grocery stores, parking, chemist shops, cabs, tea stalls, restaurants, petrol pumps, and gas and milk Booths—all accept Paytm Payments.

Payments through the app are secure as all the payment information is encrypted. Hence, it is one of the most reliable payment gateways used by people today.