Let’s say you are a bank. Or a payment gateway like PayPal, mobile wallets like Paytm, or a retailer like Walmart. You then understand the growing importance of mobile payments.

The World Payment Report 2016 says that mobile proximity payments will increase to USD 53 Bn in 2019. Compare this with USD 3 Bn in 2013 .

If you want to catch this flight, you must look beyond cash, cards, checks, and net-banking.

Do not confuse mobile payments with m-commerce, which is only e-commerce on mobile.

Mobile payments mean making payments in-store using a smartphone. Buyers can make in-store mobile payments in two ways—NFC and QR Code payments.

Challenges with NFC-based Mobile Payments

The easiest example of NFC-based mobile payments is Apple Pay or Google Pay QR Codes, which uses similar technology.

But this mode of mobile payments has not been able to take off due to two key challenges:

1. No NFC POS-Terminals with Retailers

Retailers will have to replace over 40 million terminals in the US alone to accept NFC payments. This is a capital-intensive move

2. Most consumers don’t have NFC smartphones

NFC is available in high-end smartphones only (iPhone 6 and above). This makes this mode of payment not universal.

QR Code Payments

Other than marketing, QR Codes have a wide range of use cases. They’re actively used in education, security, health care, and even payments.

Compared to NFC, a QR Code is a much cost-effective and viable option. Enabling mobile payments via QR Codes will only need the following software updates:

- Update to mobile app that includes QR Code scanning and generation features. This is possible by integrating a QR Code Generation API

- Update to POS to accept payments processed by your service

Most retailers have barcode scanning hardware. It’s integrated with their POS for billing of products. So no need for extra hardware.

Even companies like Tata Sky display QR Codes on-screen, allowing users to scan and pay instantly.

Let’s assume small businesses do not have scanners. Even then buyers can make QR Code payments. Let’s see how this works.

How Do QR Code Payments Work?

Businesses have options on how they wish to process QR Code payments. This depends on the scale of the business. It can be, self-employed, small business, or large retailer.

A. Buyer-to-Large Merchant Transactions – Buyer Scans

This system of QR Code payment applies to large retailers such as supermarkets. Let’s assume they have barcode scanners at every POS.

This is how it works:

- Let’s say buyer Megan picks up items worth $500 at Walmart and goes to the cashier for checkout

- The cashier scans each item and generates a bill of $500. He generates a unique QR Code on a screen near the POS

- Megan opens the payments app on her smartphone, scans the QR Code, and authorizes the payment

- The cashier gets a notification that Megan has made the payment and prints the sale receipt

If you think this type of QR Code payment is far-fetched, think again. Ukraine’s, Malaysia, Singapore, and Phillippines, have already adopted such buyer-to-merchant QR Code-based transactions.

In fact, Indonesia plans to launch centralized QR Code payments soon.

Here are major retailers who have already deployed this:

1. Cargo

Cargo is an in-car service startup that works directly with rideshare companies, drivers, and brand partners. It helps passengers order products through their phones.

In Jul 2018 Cargo partnered with Uber to help riders buy goods while riding.

Riders can install Cargo app on their phone and order the goods. They can make payment using a QR Code. Once rider scans the QR Code and makes payment, Uber driver hands him over the goods.

2. Paypay

Paypay is a joint venture of Softbank and Yahoo Japan. They jointly announced Paypay to be lunched in Japan in fall 2018. Paypay is a barcode (QR Code) based smartphone service.

Users will need to have Paypay app on their phones. App will offer an option to select a payment method amongst credit card and electronic money.

Stores will have merchant QR Codes to receive payments. Customers will scan this QR Code with Paypay app to make payment.

Also, in 2018, Beijing Inspiry Technology Co. Ltd. launched mobile payments in Japan.

Other such QR Code based apps to accept payments are Quickpay and Takeme Pay.

3. Walmart Pay

In 2015, Walmart added Walmart Pay to it’s app. They did this to get rid of the extra fees charged by credit card companies and Apple Pay.

Using Walmart Pay app, buyers can pay with any major credit, debit, or pre-loaded gift card.

Inspired by this, and especially post-pandemic, major e-commerce brands like Flipkart introduced QR codes as a pay-on-delivery option.

4. Tata Power

Post demonetization in Nov 2016, India saw a revolution in QR Code payments. Earlier Saarthi, then Tata power digitised payments. In Aug 2017, Tata power added QR Codes to electricity bills in Mumbai, India.

By scanning the RQ Code, people can see their bill details and pay their bill instantly.

In May 2017, the Swiss Payment System (Switzerland) also took a similar step. It got digitised by introduction of QR Codes on bills. It allows merchants to display a printed QR Code. Customers can scan this QR Code with Swiss e-wallet (TWINT) to make payments.

5. City Union Bank

College students in Chennai can now use QR Codes to pay their college fee. The City Union Bank in Chennai has made this possible using QR Codes. Sri Ramachandra Medical University and SASTRA University are two colleges the bank’s backed.

Going cashless has made it easier for students to pay their fee in spite of the demonetization of INR 5oo and 1,000.

“With QR, it becomes tap and go. Students only have to scan the QR code and the amount will automatically get debited from their account. At SASTRA University, Tanjore, we also opened bank accounts for all students with additional benefits like e-wallets” – N Kamakodi, CEO, City Union Bank.

6. Target Pay

In Dec 2015, there were reports that Target was building it’s own QR Code Payments app. Like Walmart, the move was to defy Apple Pay.

“Target’s entry would create a powerful new competitor in a small, crowded market, challenging Apple Inc’s Apple Pay, Alphabet Inc’s Android Pay and Samsung Electronics Co Ltd’s Samsung Pay” — Reuters.

Also, in 2016, Samsung collaborated with Alipay to allow Alipay users make digital payments.

7. NiYo App

Like BHIM, NiYo is an Indian app. It uses NiYo smart cards to help employees make digital payments at office canteen.

NiYo installed QR Codes at canteen counters in their customers’ offices. Using the employee app, Employees can scan these QR Codes at office canteen to pay for their meals.

Similarly, State Railway of Thailand (SRT) also uses QR Codes to help passengers buy train tickets. They can find a QR Code on electronic data capture device at the station. And scan the QR Code on their mobile using Kasikorn bank’s appilcation to make payment.

8. First National Bank

In January 2019, FNB announced the expansion of a digital payments system. FNB aims to help customers and businesses make and accept QR Code payments via FNB Banking app.

B. Buyer-to-Large Merchant Transactions – Merchant Scans

There is another variant to this QR Code payment method:

- Instead of scanning a QR Code generated on the cashier’s screen, Megan generates a QR Code on her app. Or Megan owns a card with a QR Code

- The cashier then uses his barcode scanner to scan this QR Code and complete the payment.

1. IGI Metro

Delhi metro train is a system that serves Delhi and its satellite cities like Noida, Gurgaon, Faridabad, etc.

IGI Metro falls on orange line of Delhi Metro. To make travel hassle-free, Delhi Metro Rail Corporation (DMRC) is planning QR Code based payment.

Passengers will be able to pay for their ride through a QR Code on their phones. They’ll need Bharat QR Code installed on their phones for this system to work.

Passengers can download the app and link their bank account with it. They can then generate a QR Code. AFC gate at the IGI metro line will scan this QR Code and fare will be collected.

2. Starbucks

For a long time now, Starbucks has been using this method of payment. Customers have cards with QR Codes. Instead of swiping a credit/debit card, the cashier scans the QR Code using a fixed scanner. The system deducts the bill amount from the prepaid card.

Customers also have the option of using a ‘virtual card‘ on their Starbucks app.

(Image Source: 2D Code UK)

The Starbucks’ payments app has approximately 12 million users. The company processes approx. 6 million transactions every week.

3. Paypal

In 2014, Paypal introduced mobile payment in its app.

Customers need to check-in the location and the app generates a QR Code. The merchant then scans the Paypal QR Codes to get the payment.

4. vBarista

vBarista—a coffee vending machine in Malaysia uses QR Codes to accept payments.

The customers need to set up an account on vBarista website. They can then make a prepaid payment on their smartphone to generate a QR Code. This QR Code, when scanned at vBarista machine, completes the transaction to dispense customers their cup of coffee.

5. Alipay

Alipay, one of China’s leading e-wallets introduced QR Code payments in The Body Shop. Chinese customers visiting London could make cashless payments at three Body shops stores. The three stores are in -Covent Garden, Oxford Street and Regent Street.

Customers would have to generate a QR Code on their Alipay app. Getting the QR Code scanned at The Body Shop store completed the transaction.

6. Kroger Pay

It was launched in 2019 by Kroger, a popular grocery chain in the US.

It allows customers to generate a QR Code in the Kroger app to make payments during their check-out.

C. Buyer-to-Small Business Transactions

This mode of QR Code payments applies to small businesses and retail outlets. Let’s assume they do not have barcode scanners at POS.

This is how the process works:

- Megan picks up items worth $10 at a small store

- The cashier requests her to make a payment and points at a printed QR Code near the POS

- Megan opens the payments app, scans the QR Code, enters the amount, and authorizes the payment

- The cashier gets confirmation via SMS

Note that in this case, the buyer enters the amount and the merchant has a permanent QR Code. This QR Code helps the buyer app to identify the merchant account.

This mode of QR Code payment is also popular and used by:

1. Chase Bank

In 2015, Chase Bank introduced a digital wallet, Chase Pay. This app allows customers to make payments via their smartphones by displaying a QR Code on the app.

The QR Code when shown and scanned by the cashier, makes a quick payment.

2. Shell (via Paypal)

Shell Britain has introduced a Paypal-powered payment option called ‘Fill Up and Go’. Consumers can make a payment at Shell pump-stations by scanning a fixed QR Code.

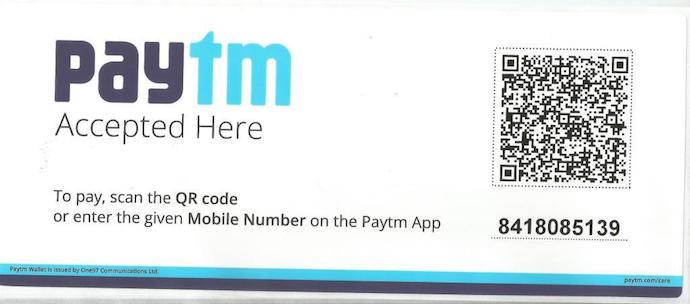

3. Paytm (India)

In 2015, Paytm, one of the largest payment processors in India, added a QR Code payment feature in its app.

Paytm QR Codes were the first to include small merchants in the cashless/cardless payments network. This means street vendors, autorickshaw drivers, electricians, etc.

“The existing 10,000 merchants, who enable topping up of Paytm wallets with cash, will also be encouraged to accept QR code-based payments as a large number of these points are kirana shops. Shortly, the company will also launch a merchant application that will give retailers a wider range of functionality in addition to generating dynamic QR codes that incorporate payment information”- said Nitin Misra, Head of Paytm’s Payment Products during launch of the feature.

Within a year of the launch, Paytm has seen exponential growth. In Nov 2016, Paytm clocked a record 5 million payments transactions per day.

This growth is also a result of demonitization initiative by the Indian Government. In Nov 2016, Indian Prime Minister declared a ban on Rs. 500 and Rs. 1000 cash notes, pushing people to move to cashless payments.

By this time, Paytm had about 850,000 offline merchants. The company is aiming 5 million merchants by the end of the financial year. As of 2024, however, the number of registered merchants with Paytm has soared to 40 million.

Since Dec 2016, Paytm also allows users to make cashless transactions at toll booths. Travelers can make payments by scanning QR Codes across major toll booths in India.

Another major reason behind its growing popularity is the Paytm QR Code Scanner, which enables users to easily scan any payment QR code and complete transactions effortlessly.

Also in Dec 2016, Paytm introduced QR Code payments to small merchants in Shillong. This included major farmers’ markets.

“Our latest merchant on-boarding drive is aimed at helping wholesalers across Shillong to accept Paytm. The goal is to make payments more inclusive and extend our QR Code PoS solution to the widest set of merchants across India.—Nishit Sinha, General Manager, Paytm

Besides Paytm, PhonePe QR Code payments are also gaining traction as one of India’s leading digital payment methods.

Even Amazon has stepped in with Amazon Pay UPI QR Codes, allowing users to pay at local stores and kirana shops by simply scanning a merchant’s code using the Amazon app

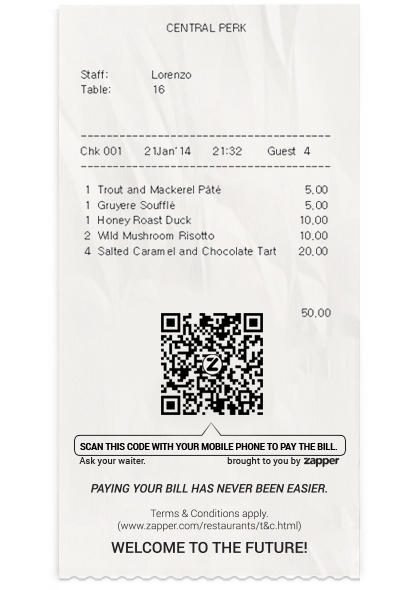

4. Zapper

Zapper is a mobile payments provider for restaurants and also uses this method. Participating restaurants add a QR Code on every bill. Customers can pay using the Zapper app.

5. Bitcoin transactions

This is how bitcoin transactions are also processed. The payer scans the QR Code provided by the recipient and the transfer of bitcoins is possible. See hoe you can create your own bitcoin QR Code.

6. Masterpass QR Code

Another example of a buyers-to-small business transaction is the Masterpass QR Code.

Ecobank group with Mastercard launched the Masterpass QR Code in Nigeria, Africa. This allows consumers to make digital transactions with small, medium and micro enterprises.

D. Peer-to-Peer Transactions

This mode of QR Code payment applies when an individual needs to pay another. For example, friends, family members, or self-employed professionals.

This is how it works:

- Megan got some plumbing work done from Mark, the plumber and she now owes him $50

- Mark opens the payments app and generates a QR Code worth $50

- Megan opens her payments app and scans this QR Code on Mark’s phone to allow the transfer

- The transfer is complete and both Mark and Megan receive an SMS confirmation

The following services offer P2P transactions:

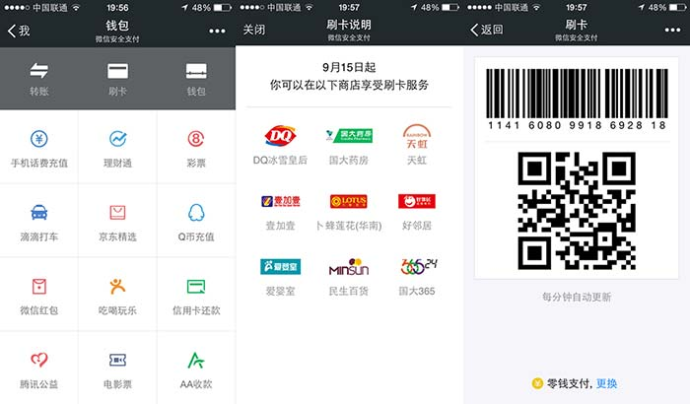

1. WeChat Pay

WeChat is China’s most popular mobile-only instant messenger service. As of Mar 2016, WeChat had approx. 762 million users.

Now, WeChat is also a mobile wallet. Using the app, users can make P2P transactions by scanning QR Codes. Also, it is possible to make purchases at participating retailers.

Popular mobile wallets such as Paypal and Paytm also allow P2P transactions via QR Codes.

Banks are now allowing P2P transactions through their apps. This is to make it easy for account-holders to transfer money. No need to register payee.

3. Zelle QR Code

Zelle is a US-based peer-to-peer payment system backed by major banks such as Chase, Bank of America, and Wells Fargo.

Let’s say Rachel needs to pay her friend David for dinner. Instead of typing his email or phone number, she simply opens her bank app, scans David’s Zelle QR Code, and confirms the transfer.

The money moves instantly—no need for account details or external wallets.

Zelle’s QR Code feature is integrated into participating bank apps, making it a secure and seamless way to send or receive money among individuals, freelancers, or even local sellers.

3. SBI Anywhere

State Bank of India (SBI) is India’s largest bank with total assets over USD 300 Bn.

In 2015, SBI added QR Code payment feature in its Anywhere app. The receiver can generate a QR Code of their bank account and share it with the payer. The payer can make the payment by scanning this QR Code using their own SBI Anywhere app.

For businesses of all sizes — small or large — QR Code payments is the easiest way to go cashless. It is far more inclusive than NFC-payments and much more affordable.

Also, see how India Post Payments Bank (IPPB) rolled out QR Cards for digital payments.

From the examples above, it is clear that every new-age business is adopting QR Code payments. Are you?

If you are looking to add QR Code generation in your information system or mobile application, you can integrate your app with Scanova’s QR Code Generation API.

Payments by QR Codes are also expected to go live in India very soon.

The upcoming Kumbh Mela at Nashik in July/August 2015 is the perfect ground for testing payments through QR Codes

If I display a unique QR code at my general store.

I want to know how my different bills will be connected to the payment made by different customer to same QR code.

Am I asleep? Because you look like a dream!

Thanks to the writer for turning tax-time tears into cheers.