PhonePe QR Code Payments: All You Need To Know

The use of QR Codes today is not unusual. From functional use cases to promotional purposes, QR Codes are being used everywhere. And among them, payments is one of the sectors, which uses QR Codes most widely.

Making payments by using QR Codes is not an uncommon site today. It is quick, easy, and secure.

From your local grocery shop to big brands in the market—all accept QR Code based payments. And you make such payment by using payment apps such as PhonePe.

PhonePe, one of India’s most popular QR Code based payment apps is based on BHIM UPI. Just like Paytm QR Code payments, the app provides cashless payments in a safe and secure environment. And offers multiple ways to transfer a payment.

Keep reading to know all about PhonePe QR Code payments.

A. How to find your PhonePe QR Code

PhonePe QR Code helps you send and receive money in your PhonePay account. For this, you obviously need the PhonePay app installed in your phone.

To find your PhonePe QR Code, here are the steps you need to follow:

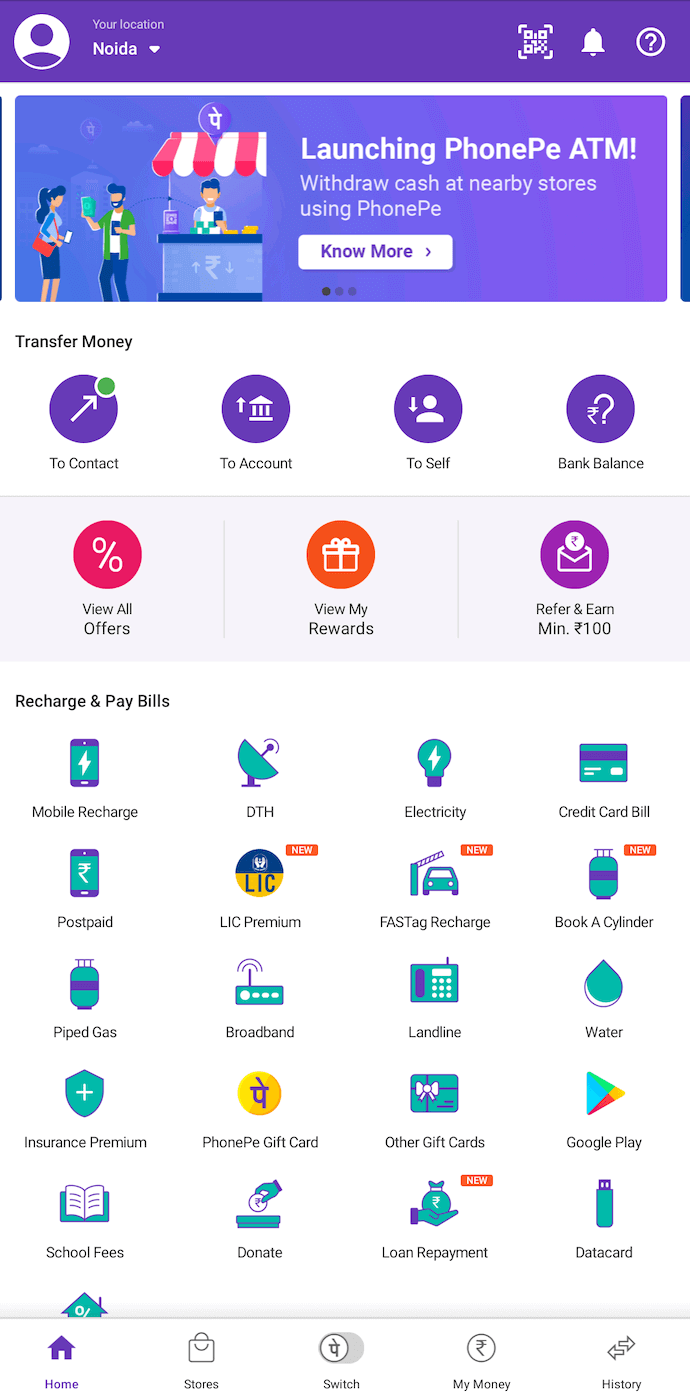

1. Log in to your PhonePe account using your registered mobile number and four digit password.

2. Once logged in, click on the top profile icon on the left hand side in Android. If an iphone user, swipe left on the main screen.

3. You will see a list of options. From this list, spot ‘My QR Code’ and click on it.

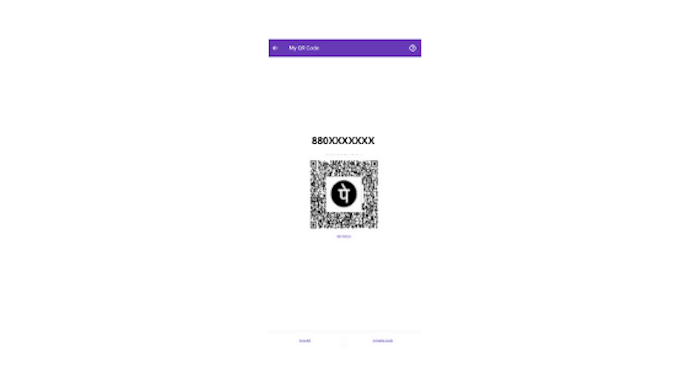

4. You can now see your PhonePe QR Code. It has the PhonePe logo in the centre. Besides, you will see QR Code details such as Username and registered number beneath the QR Code.

5. Next, you will be able to see two options:

- Download: By clicking on this option, you can download the QR Code and save it to your gallery. And then, share it with people you want to.

- Share: By choosing this option you can share your PhonePe QR Code over social media apps with your friends.

That’s it. Your friends just need to scan this QR Code and make the payment and vice-versa. The money will then be transferred to the receiver’s bank account. In the next section, we will show how.

B. How to scan PhonePe QR Code

By scanning the PhonePay QR Code of a user, you can transfer money to that user’s account.

Here is how to scan the QR Code:

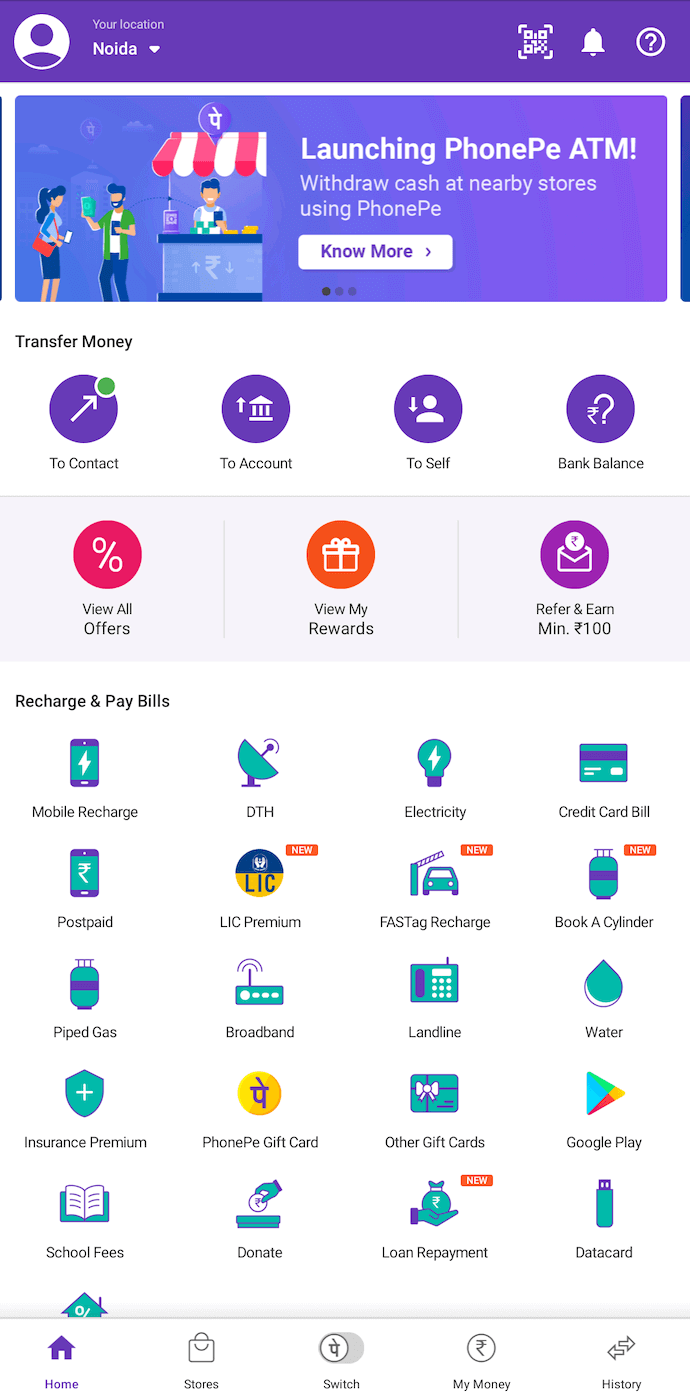

1. Log in to your PhonePay account.

2. Once logged in, you will see a QR Code scan icon in the top right hand corner of the screen. Tap on this icon.

3. The scanner will launch. You now need to keep your smartphone camera close to PhonePe QR Code you want to be scanned.

4. Once the camera detects the QR Code, you will be prompted to specify the amount to be sent. Once done, click on proceed.

That simple. This way, you can scan and pay quickly without sharing your phone number.

C. How to generate PhonePe Merchant QR Code

As a PhonePe customer, you now know how to send and receive payments.

Now, say you are a merchant and want a PhonePe QR Code to receive business payments. For this, you need to install the PhonePe Business app (Google Play, App Store).

Here is all you need to do:

a. What is required to open a PhonePe Merchant Account

You need the following:

- A bank account linked with your mobile number

- Smartphone

- Any SMS Pack or Rs.1 in your phone number used for registration. This is required as you need to send an SMS to activate your account

b. How to create a PhonePe merchant account

Now here are the steps you need to follow to set up an account:

1. Install the PhonePe business app in your account. Now, ‘Sign Up’ by specifying a username and mobile number (linked to bank account).

2. Enter one time password you receive in the specified column and proceed.

3. Now, you will be prompted to link your bank account. Here, you also need to specify the correct shop location. This will help customers to search nearby PhonePe locations.

4. Once done, your QR Code will now be generated.

Hence, this way you can easily set up your PhonePe business account and generate QR Code to receive business payments.

c. How to find PhonePe QR Code in merchant account

To find your QR Code, follow these steps:

1. Log in to your PhonePe Business account. Here, go to Profiles.

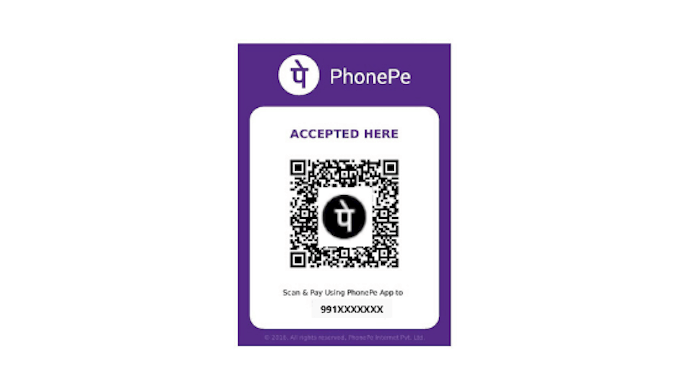

2. Now, click on Manage QR Codes. You will be able to see your QR Code.

You can now print this QR Code. And place it on your payment desk. When end users scan this QR Code, they will be able to send payment to your account.

Thus, as a merchant—be it grocery store, restaurant, cab services, or petrol pump, you simply need to print and place the QR Code at the payment desk. Your customers just need to scan the QR Code using their PhonePe app and make the payment.

The payment your customers make will automatically be transferred to your bank account.

D. Additional information on PhonePe QR Code

While PhonePe strives to make commerce a safe, secure, and seamless experience, here are some things to keep in mind to use the app like a pro:

- As customers pay by using PhonePay QR Code, they can avail cashback offers and prizes. The cashback gets added to your PhonePe wallet

- As a PhonePe Customer, you can also create your merchant account on PhonePe business app. But never make a payment to your merchant account using your PhonePe customer account. If you do this, your account may get blocked

E. Multiple ways to pay through PhonePe

PhonePe offers multiple ways to make a payment. These are:

1. PhonePe Wallet

You can add money in your PhonePe wallet. And with this, make payments to other PhonePe users. Plus, you can transfer money from your wallet to bank account.

You can also link PhonePe wallet with Jio Money, Free Recharge, and Airtel Money. And add money to it using a credit card/debit card.

And the perk is that you will still be entitled to all PhonePe cashback offers when making payments using linked wallets on PhonePe.

2. Credit/Debit Card

You can enter card details and make payments using PhonePe.

3. Net banking

You can also make payment through netbanking if you have it active.

4. Gift cards

On making payments with PhonePe, you get gift cards/credit points added to your account. You can make use of these payment methods.

Besides, you can make a Flipkart order payment through PhonePe. You can exchange or return your order to Flipkart. And can receive the refund in your PhonePe wallet.

Hence, you can choose the appropriate option to make payment.

F. How to be wary of QR Code based payment frauds

With advances in technology, comes it cons. Digital payment scams are not uncommon today. While QR Code payments have made transactions easier, it is not free of frauds.

And the best part to avoid this is to stay vigilant. And not let yourself get dragged in such situations.

Fraudsters can share a QR Code over WhatsApp or any other social media app. They can then ask for the code to be scanned to receive money in their account.

This QR Code, a feature in some UPI apps such as PhonePe, is in fact a collect request. And as you scan and enter your pin, you have already stepped into the scam loop. The next thing you see is, all your bank account balance swiped.

To avoid such fraudulent scenarios, you should not share confidential details such as your card number, expiry date, PIN, OTP with anyone. Besides, do not entertain any calls asking to share your card details or the OTP received, however genuine they may appear.

Your presence of mind and awareness is the key to keep yourself at bay from such scams.

So, now you know how QR Codes have made it so easy to make payments. With apps such as PhonePe and Paytm, you can make transactions, which are quick, easy, and secure.