Banking QR Codes

Banks, non-banking financial companies (NBFCs), fintech companies, and all financialorganizations can use Scanova's QR Codes to enhance customer engagement, streamline

transactions, and improve security measures

QR Codes for financial institutions

As BFSI (banking, financial services, and insurance) institutions increasingly adopt digital solutions, QR Codes bridge traditional banking and modern technology. They facilitate seamless interactions, allowing customers to perform various banking activities with a scan. This innovative approach simplifies processes and caters to the growing demand for efficient, user-friendly banking experiences.

-

According to DataProt, the global mobile banking market will grow from $692.5 million in 2021 to $1.3 billion by 2028.

-

As per research, global QR Code payments is expected to total $2.7 trillion by 2025. Number of users are projected to reach 2.2 billion.

-

According to eMarketer, approximately 50% of China's population is expected to use the QR Code payment system. This percentage rose to 60.5% in 2023.

You can also harness the power of QR Codes

Financial organizations can use QR Codes to boost

engagement and efficiency

Secure Transactions

QR Codes facilitate fast and secure transactions by providing an encrypted link between customer and financial institution. As customers scan a QR Code, they can complete payments or transfers with confidence, knowing that their data is protected through advanced encryption technologies.

QR Codes facilitate fast and secure transactions by providing an encrypted link between customer and financial institution. As customers scan a QR Code, they can complete payments or transfers with confidence, knowing that their data is protected through advanced encryption technologies.

Improved Accessibility

By using QR Codes, financial services become more accessible to a wider audience. Customers can easily scan codes to access online banking platforms, mobile apps, and more without navigating complex websites. This ease of access is beneficial for those who aren't tech-savvy.

By using QR Codes, financial services become more accessible to a wider audience. Customers can easily scan codes to access online banking platforms, mobile apps, and more without navigating complex websites. This ease of access is beneficial for those who aren't tech-savvy.

Streamlined KYC Processes

QR Codes can simplify the Know Your Customer (KYC) process by allowing customers to scan a code that directs them to a secure online form. This enables customers to submit their identification documents and personal information digitally, reducing the time and effort required for compliance.

QR Codes can simplify the Know Your Customer (KYC) process by allowing customers to scan a code that directs them to a secure online form. This enables customers to submit their identification documents and personal information digitally, reducing the time and effort required for compliance.

ATM Transactions Without Cards

Financial institutions can implement QR Codes at ATMs, allowing customers to withdraw cash or access their accounts without needing a physical card. Customers simply scan the QR Code displayed on the ATM screen using their mobile device, enhancing convenience and security.

Financial institutions can implement QR Codes at ATMs, allowing customers to withdraw cash or access their accounts without needing a physical card. Customers simply scan the QR Code displayed on the ATM screen using their mobile device, enhancing convenience and security.

Instant Information Sharing

With QR Codes, financial organizations can provide instant access to essential information. When customers scan a code, they can view details on account features, loan options, and more. This immediate access empowers customers to make informed decisions and enhances overall engagement.

With QR Codes, financial organizations can provide instant access to essential information. When customers scan a code, they can view details on account features, loan options, and more. This immediate access empowers customers to make informed decisions and enhances overall engagement.

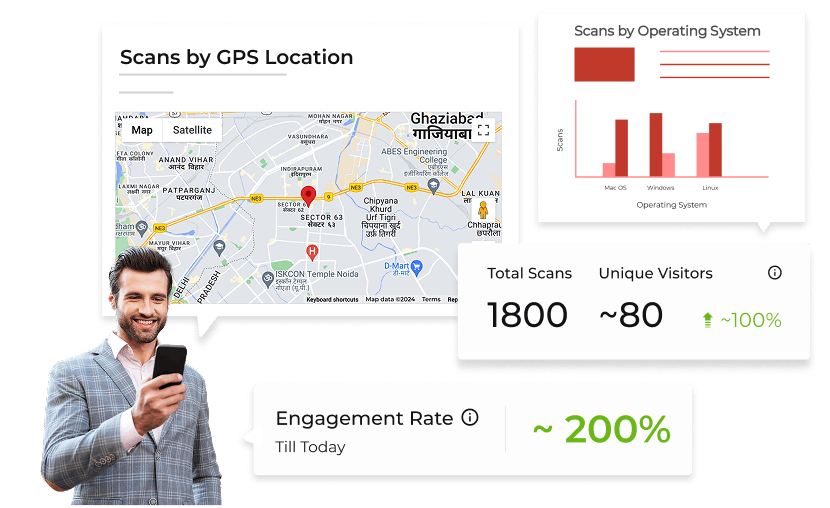

Data Tracking

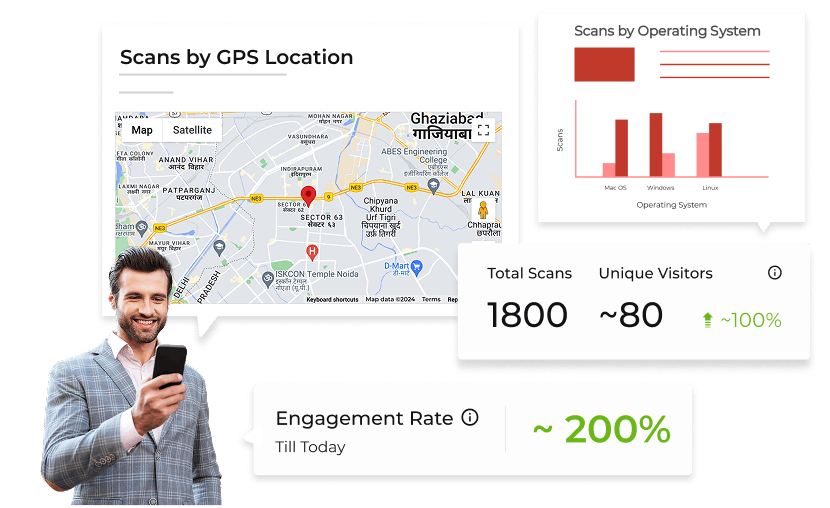

QR Codes provide valuable insights into customer interactions and preferences. Financial organizations can analyze data such as total scans, geographic locations, and other user demographics to understand consumer behavior. This allows institutions to tailor their services/strategies.

QR Codes provide valuable insights into customer interactions and preferences. Financial organizations can analyze data such as total scans, geographic locations, and other user demographics to understand consumer behavior. This allows institutions to tailor their services/strategies.

Enhanced Customer Experience

QR Codes streamline various banking processes, such as account openings and loan applications, making them faster and user-friendly. Instead of filling out lengthy forms or waiting in line at a branch, customers can simply scan a QR Code to initiate transactions or access services.

QR Codes streamline various banking processes, such as account openings and loan applications, making them faster and user-friendly. Instead of filling out lengthy forms or waiting in line at a branch, customers can simply scan a QR Code to initiate transactions or access services.

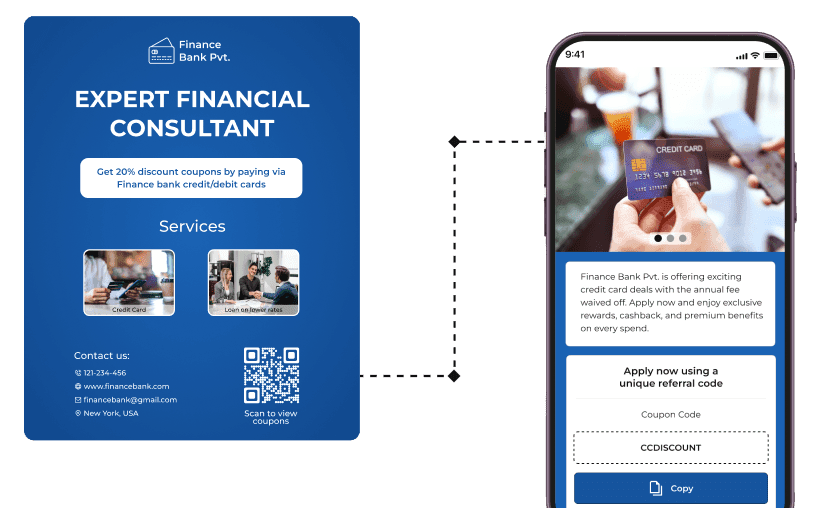

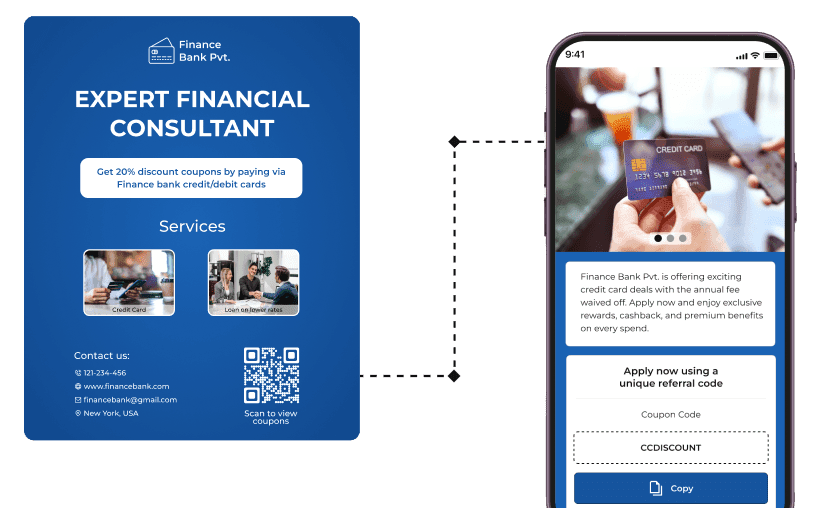

Efficient Marketing

Financial institutions can leverage QR Codes in their marketing materials to drive traffic to websites or mobile applications. By placing codes on brochures, advertisements, or even business cards—organizations can encourage potential customers to learn more about their offerings with just a scan.

Financial institutions can leverage QR Codes in their marketing materials to drive traffic to websites or mobile applications. By placing codes on brochures, advertisements, or even business cards—organizations can encourage potential customers to learn more about their offerings with just a scan.

Engage customers like never before with Scanova

Follow these steps to create QR Codes for your use case

Select Category

Log in to Scanova. Once logged in, click on Create QR Code. Select a QR Code category.

Enter Content

Add required content like website URL, location, contact details, etc.

Create QR Code

Provide a name for your QR Code and add tags (optional). If you are creating a Dynamic QR Code, you can enable advanced features like password protection. Once done, click on Create QR Code.

Customize & Download

Your QR Code is ready. Test and download it or customize your QR Code before downloading.

Real-world applications of banking QR Codes

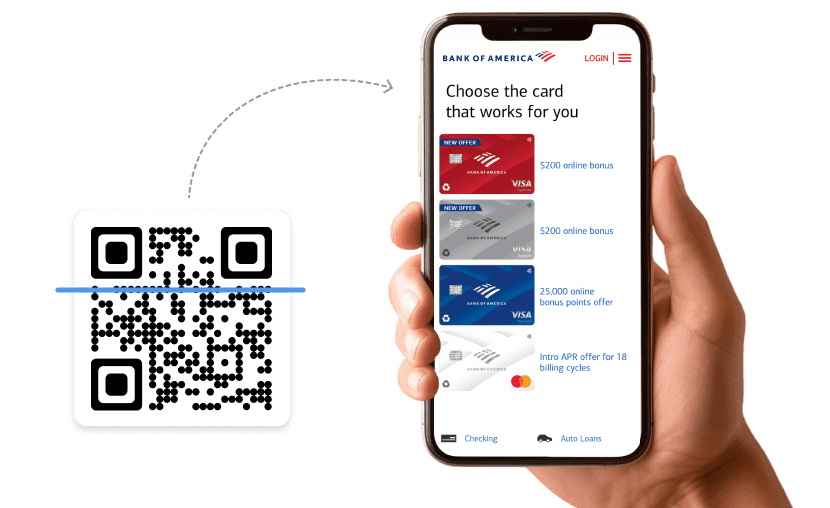

Bank of America

Bank of America has introduced a QR sign-in feature for its CashPro platform, allowing users to access their accounts by scanning a QR Code with their mobile devices and using biometric authentication. This approach simplifies the sign-in process for CashPro users, eliminating the need for manual password entry.

Bank of America has introduced a QR sign-in feature for its CashPro platform, allowing users to access their accounts by scanning a QR Code with their mobile devices and using biometric authentication. This approach simplifies the sign-in process for CashPro users, eliminating the need for manual password entry.

State Farm Insurance

State Farm Insurance incorporates QR Codes on its insurance policy documents. When customers scan these codes, they can access essential information such as payment amounts, renewal dates, and coverage details. This enables customers to manage their policies without contacting customer service for assistance.

State Farm Insurance incorporates QR Codes on its insurance policy documents. When customers scan these codes, they can access essential information such as payment amounts, renewal dates, and coverage details. This enables customers to manage their policies without contacting customer service for assistance.

OCBC Bank

OCBC Bank has become the only bank in Singapore to offer five cross-border QR payment options through its mobile app. The integration of platforms like Alipay+, UnionPay International, and more allows OCBC customers OCBC customers with Singapore bank accounts to make QR payments when traveling abroad.

OCBC Bank has become the only bank in Singapore to offer five cross-border QR payment options through its mobile app. The integration of platforms like Alipay+, UnionPay International, and more allows OCBC customers OCBC customers with Singapore bank accounts to make QR payments when traveling abroad.

Bharat QR

Bharat QR is a widely adopted payment system that allows users to make transactions by scanning QR Codes at participating merchants. This initiative has simplified digital payments for consumers and merchants across India, promoting a cashless economy and enhancing financial inclusion.

Bharat QR is a widely adopted payment system that allows users to make transactions by scanning QR Codes at participating merchants. This initiative has simplified digital payments for consumers and merchants across India, promoting a cashless economy and enhancing financial inclusion.

Get desired results for your business with Scanova

Why top financial institutions like MassMutual and USA Mortgage are using QR Codes

Editing Flexibility

Advanced Tracking & Analytics

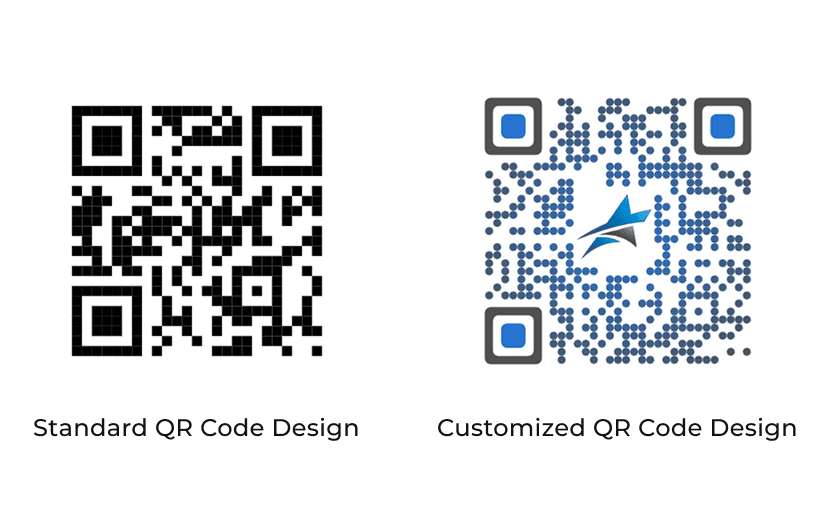

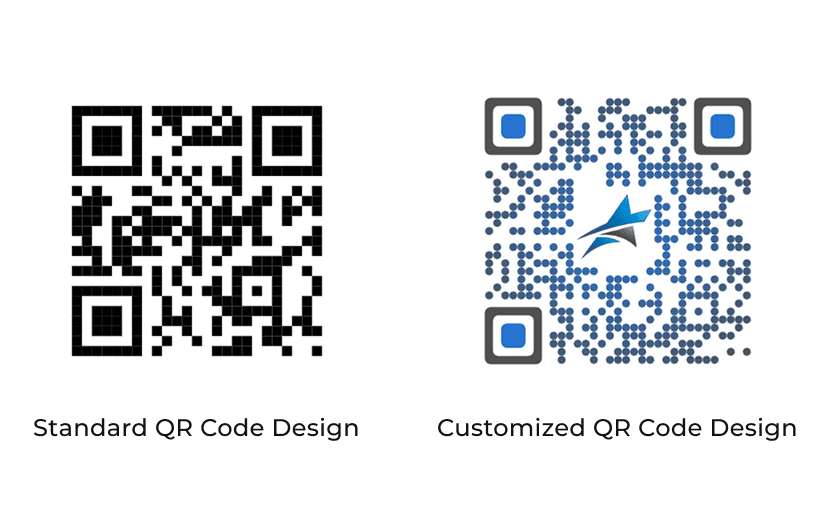

Customizable QR Codes

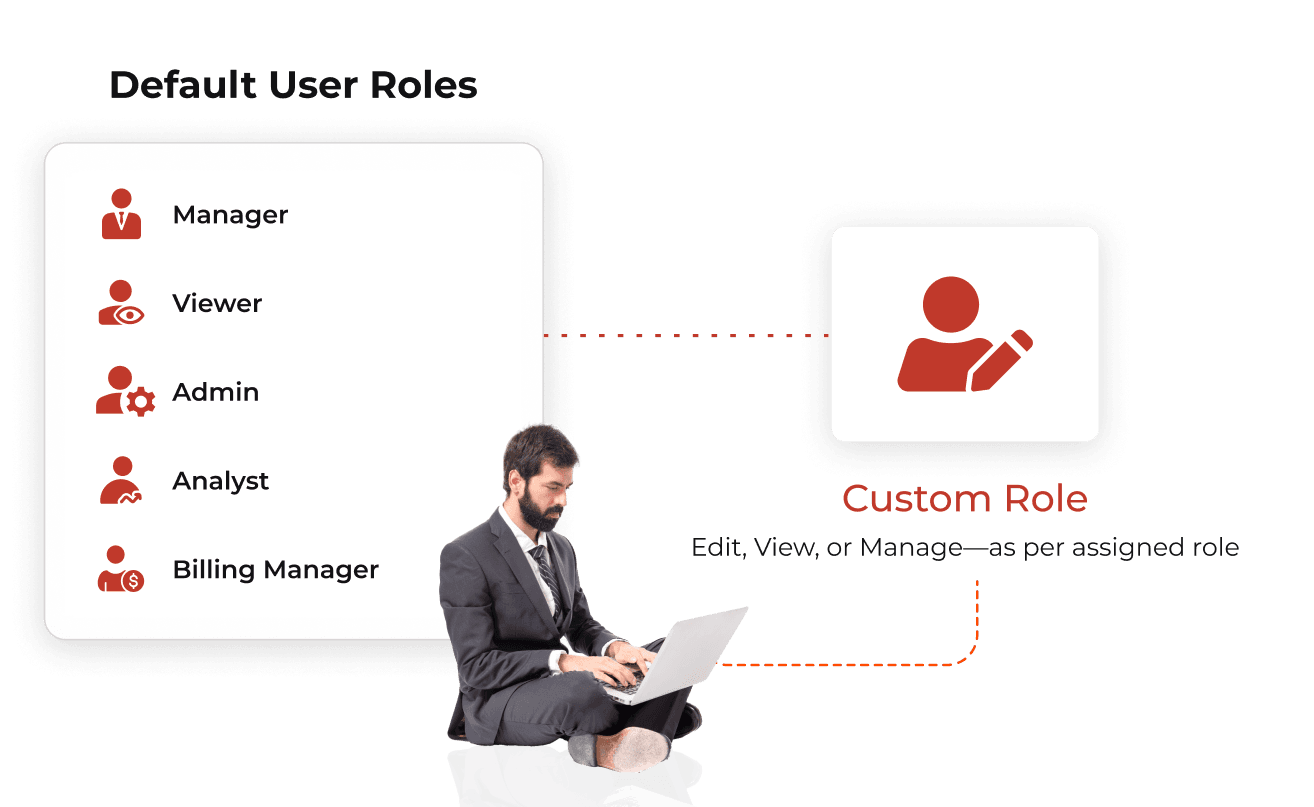

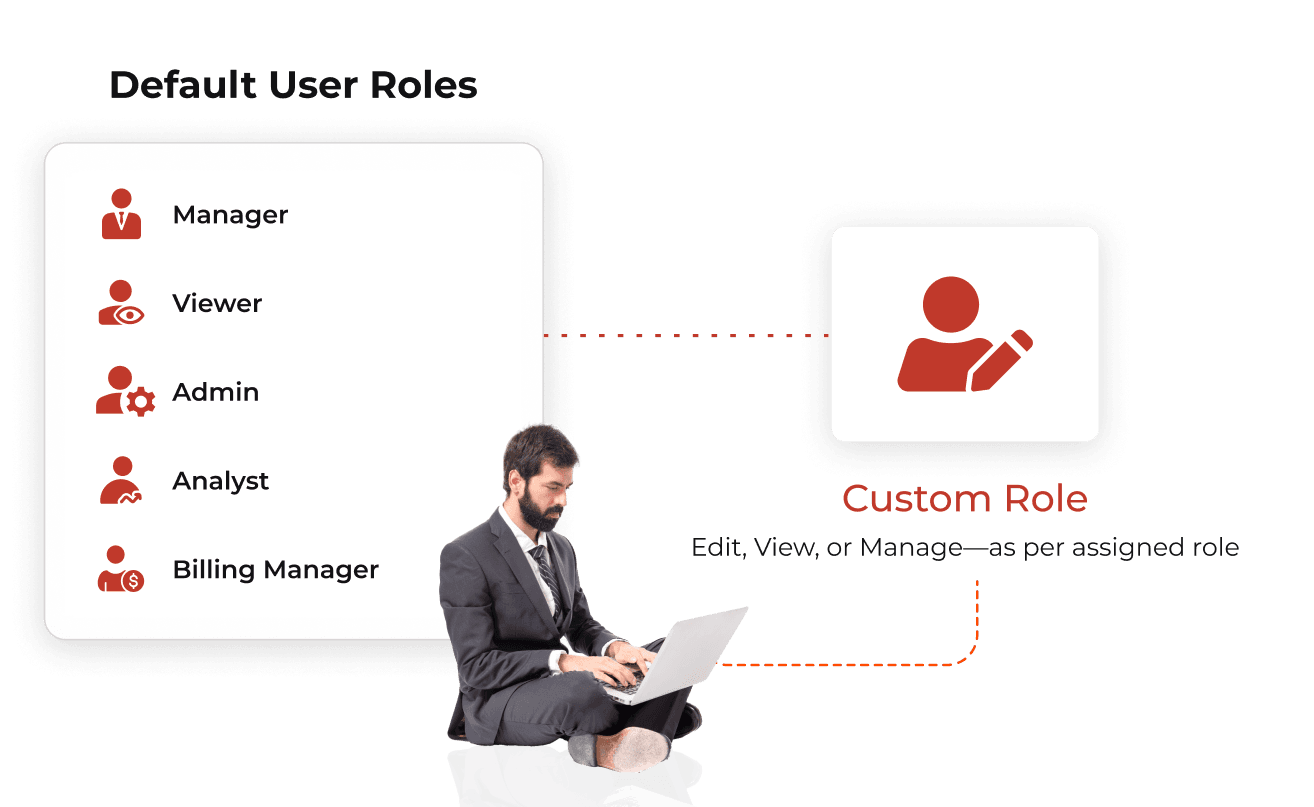

User Access Management

Scanova's commitment to data security

Scanova protects user data by adhering to rigorous security standards such as ISO/IEC

27001:2022, GDPR, and SOC2

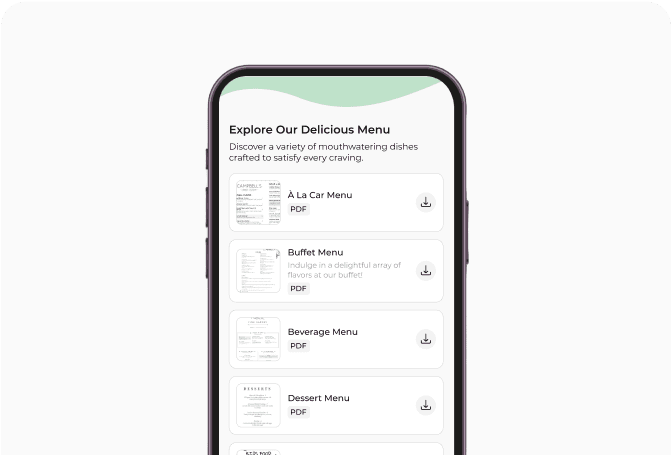

Banking QR Code categories by Scanova

Best brands in the world trust Scanova

5 best practices to double your scans

Prominent placement and design

Clear call-to-action (CTA)

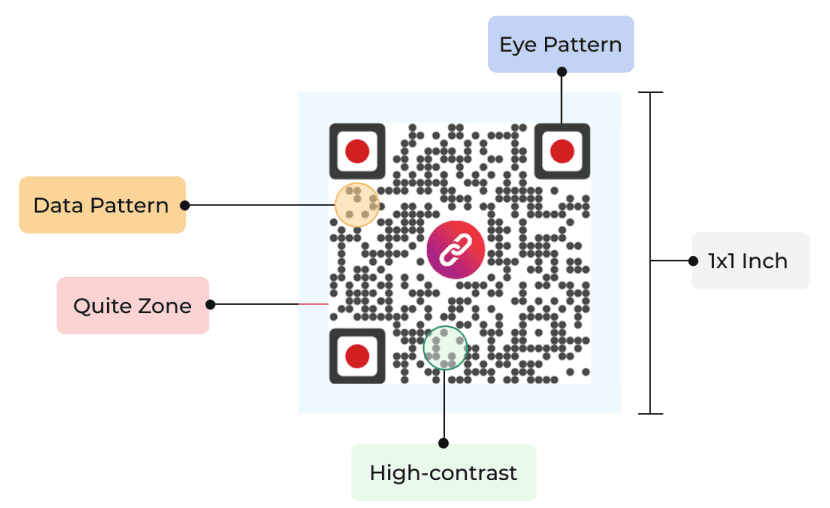

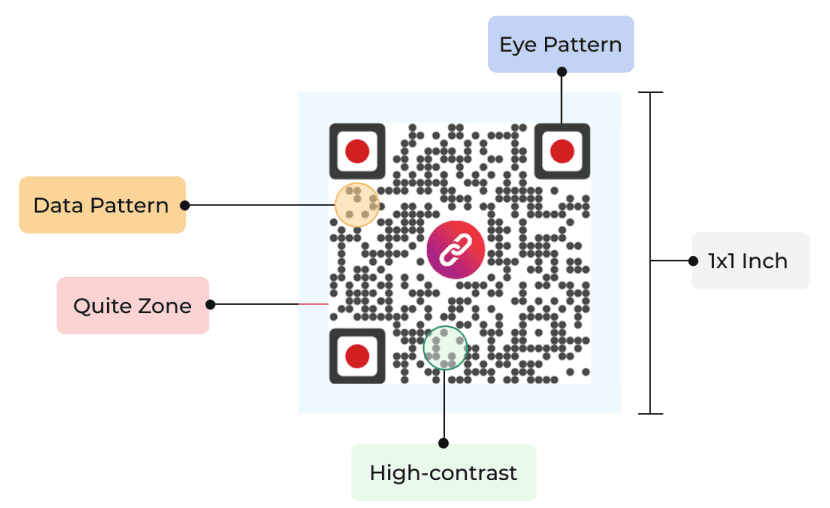

Ensure scannability

-

A QR Code's recommended minimum dimensions (height and width) are 1 inch (3 cm or 115 pixels).

-

When designing colored QR Codes, opt for high-contrast combinations between the foreground and background colors.

-

Strive for an approximate ratio of 10:1. For example: If a QR Code needs to be scanned from a distance of 100 cm, it should measure at least 10 cm in width.

-

Additionally, ensure that the area around your QR Code is well-lit to improve the chances of successful scanning.

Link to valuable content

Print quality matters

Frequently Asked Questions

Get quick answers related to Scanova’s banking and insurance QR Codes

How do QR Codes facilitate paperless transactions in banking?

QR Codes enable banks to share information quickly and efficiently without the need for physical documents. By scanning a QR Code, customers can access important details and services online, reducing reliance on printed materials and streamlining processes.

How can QR Codes improve the customer onboarding experience?

QR Codes can simplify the onboarding process by enabling customers to upload necessary documents online through a scanned code. This reduces waiting times and paperwork, making it easier for new customers to complete their applications and enhancing overall satisfaction.

Are QR Codes used in physical bank branches? What benefits do they provide?

Yes, QR Codes are used in physical bank branches to offer quick access to information about services, promotions, contact details, and more. This enhances customer engagement by providing relevant information, allowing customers to find what they need without waiting in line.

Can I integrate my QR Code data with existing marketing tools?

Scanova easily integrates with various platforms and tools, including Google Analytics. This integration capability allows financial organizations to streamline their marketing efforts and enhance customer relationship management by connecting QR Code data with existing workflows and systems.